Photo: Poster to the meeting

The $8.6 million Belmont will receive from the $1.9 trillion American Rescue Plan has been the topic of a heated debate ever since it was signed into law by President Biden on March 11.

In one corner are those who are attempting to defeat a $6.2 million Proposition 2 1/2 override who see the money filling town coffers with more than enough funds to render the override moot.

On the other side, proponents of the override contend that most of the cash is restricted to reimbursing town revenue lost due to COVID-19 and can’t be used to as a one-time stop gap for the town’s structural deficit.

And in the past three weeks, “I am seeing some things that are being misreported in regards to those numbers,” Town Administrator Patrice Garvin told the Select Board Monday, March 29.

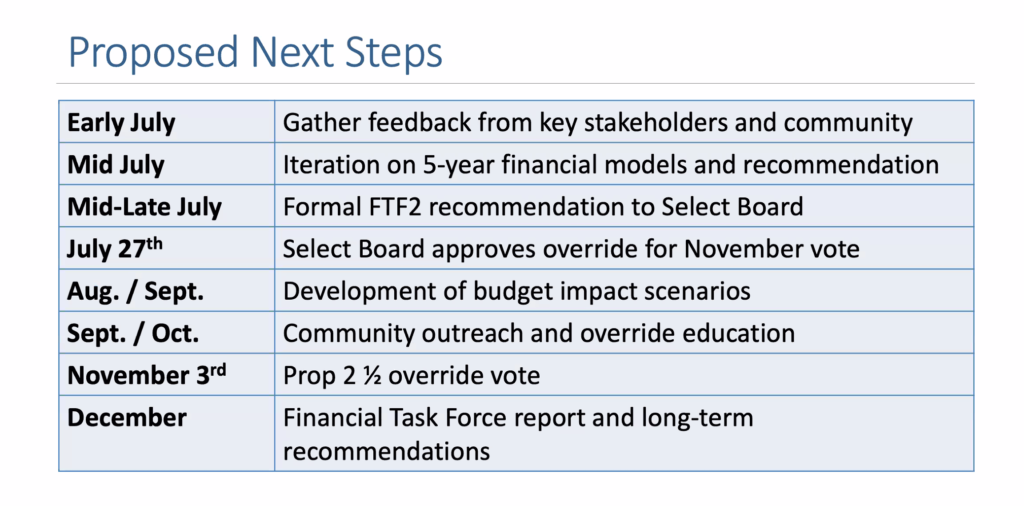

In an attempt to provide a clearer picture of the funds and how they can be used for, the Financial Task Force II and Warrant Committee are inviting the public to a virtual presentation to share the latest information regarding the new Federal Aid Bill and also provide an update on projected state aid in the coming fiscal year 2022.

When: Wednesday, March 31

Time: 7 p.m.

Zoom: https://us02web.zoom.us/j/87434286149

Questions will be taken at the conclusion of the presentation period

through the Q&A function. The meeting facilitator will inform those

attending when questions can be submitted.