Photo: Tom Caputo, chair of the Financial Task Force 2.

With town finances at the precipice of a financial black hole coming this time next year, the Belmont Select Board will ask voters to pass the largest Proposition 2 1/2 override in the town’s history of between $12 to $14 million.

“It’s a big ask,” said Tom Caputo, Select Board member and chair of the Financial Task Force II Committee on Thursday, June 25 as the town faces the duel impacts of the COVID-19 pandemic on state and local revenues while battling a persistent structural deficit that has become the hallmark of Belmont’s fiscal woes.

“It is an incredibly challenging time to contemplate anything of this scale even in a great economy … It is particularly challenging in an environment where we’re looking at an economic recession,” said Caputo.

If the override is successful, the impact the average home assessed at $1.2 million will result in an additional $1,250 to a homeowner’s annual tax bill. If rejected, the town and schools would be required to make crippling levels of cuts in staffing and teachers, limit or cancel programs and cuts in essential services such as police, fire and schools.

“What we hope folks will appreciate is that there is no one silver bullet going to solve this problem,” said Caputo, pointing out that bridging the $12 million deficit with just employee cuts would require a reduction of approximately 120 full time equivalents (FTEs) positions.

“This is not trimming [costs], these are substantial reductions in order to achieve” balanced budgets starting with fiscal year 2022, said Caputo.

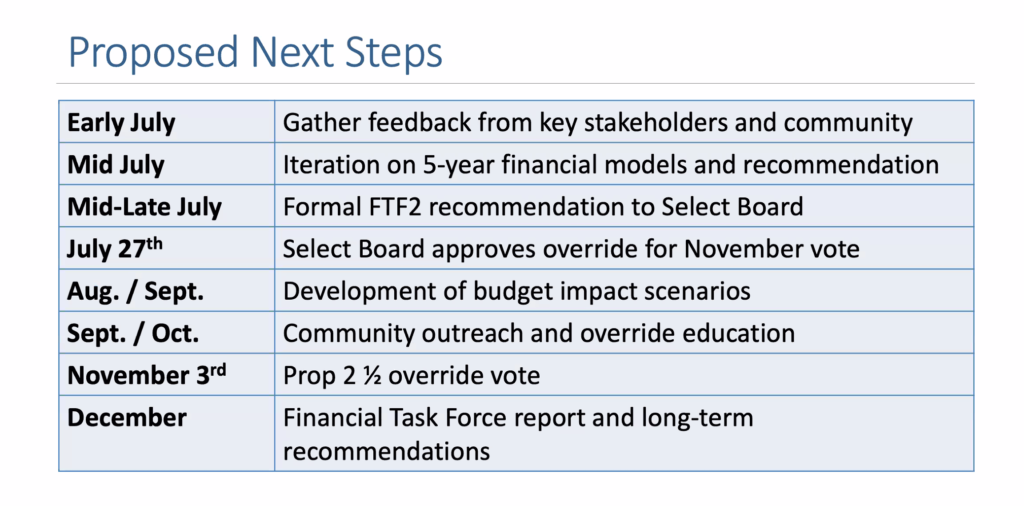

(Image: Town of Belmont)

While the date of the override remains fluid, the task force’s preferences are to link the vote to the Tuesday, Nov. 3 presidential election as the town can anticipate an 80 percent voter turnout – in 2016 82.4 percent of voters cast a ballot – which will provide a “fair and accurate read” of residents sentiment, according to the Select Board’s Adam Dash.

Others believe the November date doesn’t give the town enough time to “educate” voters on the need for a revenue push of such a historic amount.

The reason for the proposed override is the combination of the town’s structural budget deficit which is the result of the town’s nearly exclusive reliance on residential property taxes coupled with a 2 1/2 increase limit on the town’s property tax levy.

While constrained on the revenue side, town expenses related to skyrocketing school enrollment, a steady need for capital improvements and key cost drivers such as health and pension costs, employment expenses and mandated school services continue to rise yearly by 3.5 percent to 4.5 percent. The structural deficit alone would have required an $8 to $9 million override to close in fiscal 2022. Add the continued impact of the COVID-19 on state and town revenue of $3 to $4 million and the override comes in the $12 million range.

The Board and Task Force have expressed some optimism if the override is approved the funds will last several years more than the current projected three years just like the 2015 override.

The most recent Prop 2 1/2 override occurred in April 2015 when voters passed – 55 percent to 45 percent – a $4.5 million increase in property taxes to fund schools, town services, capital projects, road repair and sidewalks. It was the only override to pass in the past 17 years.

Originally meant to last three years, a combination of thoughtful planning, fiscal prudence and a good state economy allowed the town to stretch the funds through the current fiscal year.

The joint committees also agreed that seeking voters’ approval for an override must be conjoined with a concrete five-year budgetary blueprint to mitigate the structural deficit by seeking new sources of revenue and discovering ways to tame costs associated with employee pensions and health insurance.

Despite a great deal of heavy lifting by Belmont officials, residents and town boards and committees to pass the unprecedented override, Dash stated his confidence the measure will pass voters muster.

“I think we have a compelling case,” he said. “[The override] is not due to bad management … it’s due to just some structural issues we’re trying to address in addition to the COVID which is totally unpredictable.”

“If we put the case out there and we show people what they’ll get with it and what they’ll lose without it, they’ll make a fair decision and we’ll move on,” Dash said.

If the town is so desperate for money, why build office/business complex near the alewife station, but bunch of apartment buildings. That is much higher revenue without increase burden on the current school system?

Belmont has no plan for the future. Instead of worrying about cell phone towers giving your kids brain cancer, we could have invested resources in revenue generating that would actually make spending levels sustainable.

Instead, there are no more houses to build and extreme deficits from decades of “small town” charm and a lack of a plan to sustain future spending. Supporting more people obviously costs more. Having some sort of plan to embrace modern technology to reduce costs *and* generate new revenue streams to modernize the town is the only way I’ll contribute another cent to yet another property tax hike. It’s already too expensive as it is, and I can’t even park my car in front of my house overnight. Get real, Belmont.

I think town government is not in the habit of being frugal because an override is always possible or increasing tax assessments is always at the ready..

Do departments within town government experience audits? Have staffing levels in departments been adjusted to reflect tech advances over the last few decades? I suspect the answer is no because there has been no incentive to do so. If the community complains, the response is to scare homeowners with the threat of service cuts, without self-evaluations.

In the last three years, I know six homeowners who have sold and left for this very reason.

I would support voting NO in November for the override.

Great idea, let’s put a stop to to those darn people who are working to teach our kids, serve our elderly, pave our streets, put out our fires, and keep this place nice to live and our property values up?

No way. These are perhaps the only people in government working for our benefit. Local taxes are the only taxes that directly benefit our community. There is plenty of federal waste. Local, not so much.

Couple of thoughts, if anyone is still listening:

1) Reassessment bears no impact on total tax revenue, only relative tax revenue. If your assessment went up more than the average did, then yes, your taxes would have gone up more than 2.5% + override + debt exclusions, but this happens at a time lag to valuation increases/changes, so you probably benefited in previous years from an assessment that was too low. Also, re *land* assessment specifically, the town has plenty of examples of knockdown value on desirable streets that suggest bare land in Belmont has significant value…

2) It takes literally *no* thought and *no* courage to say “cut spending!!”. If you don’t want to make specific and detailed suggestions, you aren’t helping advance the discussion. I have no knowledge to judge Fred’s suggestion, but at least he was specific. Also, it strikes me as illogical to express surprise that the bulk of the people who *want* to get involved in volunteer town government roles are also the same people who broadly support new schools, etc..

3) The relative metrics all show that we have among the lowest tax rates in the state per assessed value, and also among the lowest per pupil expenditures.

This fiscal crisis was predicted in 2018. Before Covid. Before the new High School. What cuts were made in the two years? What capital expenditures were delayed? What fiscal restraints were implemented? Hiring freeze? Wage freeze? Pension reform?

Taxes have increased dramatically this year due to an arbitrary and opaque assessment, increasing tax bills significantly for Belmont tax payers. Hiding behind the Belmont “tax rate is low” argument just doesn’t cut it when your overall tax bill increases 30% year-over-year?

No override. No new taxes. Make the cuts NOW.

Another $1200 !!! Add that to the “new school” overide for about a one year increase of $2000 in an individuals taxes…outrageous, especially for citizens on limited income. How about taxing all land value at the same rate, instead of taxing according to location? That would increase town income.

And as for the schools, money or price per student does not guarantee quality. Thinking that it does is a mistake!

How do you compare a $5.5 million override in Arlington that has 1.6X more taxpayers plus plentiful commercial tax revenue to a $12M-$14M override in Belmont, the largest Prop 2 ½ override in the town’s history? We just had the largest tax assessment increase in the town’s history not long ago. Enough is enough.

Thank you for your comment, Mary Lewis. You helped to prove these outrageous tax increases are the result of mismanagement, incompetence and self-serving bias. If you remember, you have already used the lack of per-pupil spending comparison for the 2015 override and congratulations, you got it! As of 2020, the taxpayers have already paid this recurring override taxes for over $22 million. However, based on your claim, the per-pupil expenditure issue seems unresolved. Where did the additional tax money go? We know it didn’t improve Belmont’s notorious roads other than the usual spending.

In 2018, the town had another chance to increase education funding for all school levels when they asked the taxpayers to fund $295 million, but the town chose to exhaust all of it to demolish the existing not even 50-year-old high school building for a new one. What they should have asked was to set aside a portion of the funding to hire effective teachers that I believe are more important for student achievement than modern buildings.

The money went to the pay for the education of the additional number of students Belmont has gained in the past decade, which I referenced in the original comment.

What is wrong with some of you?

Revenues are down catastrophically around the world and governments from the local level to the federal level are all going to face an unprecedented financial reckoning. Add to this that Belmont is trying to dig its way out of decades of fiscal and capital mismanagement at the same time that school enrollment is ballooning.

And here people are acting like a little belt tightening or revenues from a few real estate projects are going to get the town through this.

Belmont tax rates are among the lowest in the area, but property values are very high so your tax bill will be a burden. Higher taxes stink and my heart goes out to anyone who has to shoulder them on a fixed or reduced income, but the alternative is catastrophic:

“If rejected, the town and schools would be required to make crippling levels of cuts in staffing and teachers, limit or cancel programs and cuts in essential services such as police, fire and schools.”

Is that really a town any of you want to live in?

This is the time to use the four “rainy day” funds that the town reserved in recent years. Unfortunately, all the funds totaling $1.75 million were used for the school building feasibility study.

Lowering tax rate, but maxed out assessed value was a tactic for future tax increases as clearly stated in the town’s bond rating document…and that’s exactly what the town is doing for seeking the largest override in the town’s history. Belmont property taxes are no doubt, the highest in the Middlesex County, if not the entire State when comparing same selling price homes. That is the cause, not Covid. All the outrageous tax increases were already planned long before Covid. Yes, the alternative is catastrophic. It’s time to trim the excessive capital spending.

Aren’t property taxes high enough? When I moved to Belmont 50 years ago, it had a reputation of being the finest town in Massachusetts. Belmont had lower taxes compared to most other towns and provided much better services than most other towns. What happened? Where is the revenue from the Mclean property and what will the town do with the additional money that will come from the Cushing Square development? Another $1,000-$2,000 in property taxes is outrageous!The powers that be would say “this is not due to mismanagement”, I would say this town has been mismanaged for many years! We abandoned elementary schools several years ago only to have a shortage of schools, necessitating more investment. Why are we rebuilding schools that are only 50 years old? I could go on, but I think I’ve said enough. I will be sure to vote NOOOO!

As unwelcome as higher taxes might sound, they would NOT be due to any sort of mismanagement or inability to cut corners. Belmont’s school district runs on an absolute shoestring. A lot has been cut already. With a per-pupil expenditure of just over $14,000, we deliver an education at a much lower cost than our peers. Only Arlington is anywhere near comparable (at +/- $14,500), but that will change as their override goes into effect. Peer districts such as Bedford ($18,900 per pupil), Lexington ($18,700 per pupil), Watertown ($21,800 per pupil), and Waltham ($21,648), to say nothing of Cambridge (almost $30K) routinely spend more per pupil than Belmont.

We also have a much higher (meaning worse) teacher:student ratio than the average in the state. Our classes are more crowded.

To the contrary of what has been said in the comments above about mismanagement, Belmont is to be celebrated for the incredible job it does with a tiny pot of money, relatively speaking.

Last spring, Arlington asked its voters to simultaneously approve their new high school AND an operating override (https://arlington.wickedlocal.com/news/20190611/arlington-voters-approve-new-high-school-override-in-special-election). This made clear to voters that there is a difference between paying for buildings and paying for everyday expenses like good teachers. Perhaps Belmont should have done the same thing.

But we did not and now, with the COVID crisis and no extra state aid coming as a result, we have a choice: sacrifice our children’s education even further than the countless cuts have already done (from instrumental music in the lower grades, to foreign languages, to athletic fees and beyond) or accept that we cannot fund schools on air.

It’s understandable that no one wants to see another increase in taxes, but please don’t say it’s mismanagement. The facts say otherwise: The number of pupils has grown almost 20% since 2010. That means more teachers are needed, more special ed plans have to be implemented, more resources devoted.

what happened to the revenue from the Mclean property? How about. the projected property tax from the Cushing Square development? why does the town consistently live beyond its means. if the bulk of the income for the town comes from property taxes, why are we blaming covid 19 for the shortfall? I do believe that this is mismanagement over many years. When I moved to this town 50 years ago, Belmont had a reputation of lower taxes and better services.

Ron B

For years, Belmont has been ruled by an elite group of insiders (Board of Selectmen, members of Warrant Committee, School Committee, and Town meeting) who run big $$ campaign organizations for the new high school, tax overrides…, and now, a new library. Conflict of interest, anyone?

It is mismanagement and poor strategy that has pushed the town toward the situation that it is in. But just as much blame falls on the voters as it does with Town Admin! Pushing agendas and ideas that don’t fall in line with the revenue streams and overall financial realities of the town create these problems.

You know what you do in a crisis like the one we find ourselves in? You make cuts. You do without. And workers step up and find ways to do more with less.

You certainly don’t continue to cover up inefficiency and shortfalls by throwing money at them.

You know how the school system responded since the last override to boost schools? With dropping MCAS scores, dropping SAT scores, and slipping in more publication rankings than not.

Shame on the voters, shame on the fat cat employees, and shame on the town’s admin.

Pension costs are out of control and continue to rise at unsustainable rates. They need to be overhauled.

Dash said: “I think we have a compelling case, [The override] is not due to bad management … it’s due to just some structural issues we’re trying to address in addition to the COVID which is totally unpredictable.”

Compelling case? The override is absolutely due to bad management. What structural issues? There needs to be more transparency in the way Belmont government operates. It also has nothing to do with COVID as the override was decided back in 2018 per the Town Treasurer long before “COVID” was identified. The Selectmen have touted lowering residents’ tax rate by a miniscule $.67 cents per $1,000, but instead, maxed out residents’ land assessed value. It’s a tactic for the Selectmen to make room for future tax increases which had already been promised in our bond rating document. In fact, the 02/28/2019 bond rating Moody’s letter listed one of the factors that could lead to a downgrade is: “Unwillingness of voters to approve future debt exclusions and overrides.”

“You can fool some of the people all of the time, and all of the people some of the time, but you cannot fool all of the people all of the time.”

Again! How about trimming some of the fat from the budget first. Do we really need an Assistant Treasurer for $80.000 a year?

If we can’t get enough money from the federal government or from the Massachusetts government, how is it possible to get it from Belmont’s homeowners and renters? We are, after all, the people who support the federal and state governments.

This override proposal requires a lot of analysis and public input. This is a huge ask of Belmont’s residents on top of the huge bill we’re already footing for the Middle and High School.

And don’t forget the reassessment of many people’s homes this past year that added huge amounts of taxes to skyrocketing property tax

bills. As far as I know, many Belmont residents cannot keep paying these ever-increasing property tax bills.

Think about it. Some of the reasons the federal and state governments are in such dire straits is because millions of Americans lost their jobs during this pandemic. It’s naive to think that none of those unemployed people live in Belmont.

Vote No. Go ahead and make cuts. Enough is enough!