Photo: Yvonne Brown (left) and Jennifer Marusiak of Mothers Out Front.

The rotten egg smell associated with leaking natural gas – it’s actually a chemical additive called mercaptan – is an annoyance that dampens your outdoor activities or forces windows to be closed on summer nights. But the problem of leaking gas mains goes beyond the odor it emanates; the hydrocarbon mixture is harming the environment and draining resident’s pocketbooks.

That’s the warning Jennifer Marusiak of Chester Road and Yvonne Brown of Highland Road brought to the Belmont Board of Selectmen on Monday, June 27, as they sought the board’s backing for state legislation that would put a modest plug in what has become an epidemic throughout the state.

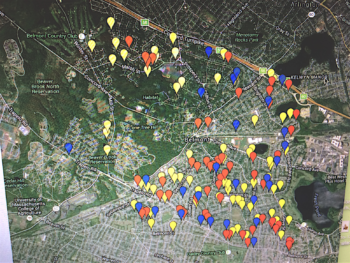

“It’s serious that we have these uncontrolled leaks in every Belmont neighborhood and the consequences are to climate change,” said Marusiak, who with Brown are members of the Belmont chapter of Mothers Out Front, a national grassroots organization seeking to implement policies to transition away from fossil fuels and towards renewable energy.

And with the Selectmen’s official endorsement of the legislation making its way through Beacon Hill, Belmont joins 36 communities across Massachusetts supporting the effort to limit the level of gas leaks statewide.

‘[Methane] has been described as carbon on steroids,” Marusiak said of the greenhouse gas that’s nearly 90 percent more efficient than CO2 in trapping heat. It also exacerbates the effects of asthma and kills trees.

In addition to the environmental damage, the leaks cost ratepayers and consumers $90 million annual in lost product, which could power 200,000 homes each year.

The reason leaks occur is due to an aging infrastructure, said Marusiak. National Grid, the gas utility in Massachusetts, told Mom’s Out Front that half the pipes running through town are cast iron or unprotected steel “which makes them leak-prone” due to changing temperatures and corrosion, said Marusiak.

National Grid will repair leaks immediately if they are indoors and in an enclosed space with the real potential of an explosion, she said. There is a second level of severity are pipes that could become dangerous if they are close to residential buildings, but the company can wait six months before fixing them.

All other leaks don’t have any timeframe on repairs, which has resulted in two Belmont locations which have had been leaking gas since 1996, said Marusiak.

“And the shocking thing [about replacing leaking pipes] it has absolutely nothing to do with the volume [escaping] … they could sit there forever,” Marusiak said, noting that National Grid acknowledged it doesn’t know the volume of escaping gas from any of the Belmont problem areas.

The women were seeking backing on two bills in front of the state legislature on Beacon Hill: House 2870 would prohibit company from passing on costs from leaks to customer – this bill has been sent to a Study Committee – while Senate 1767 would mandate utilities check for leaks when roads with gas pipes are dug up, and fix any leaks found within one calendar year.

“The support from towns are vital,” said Marusiak. “The main benefit of passing this resolution is to keep up the pressure by saying ‘we need action now’.”

“This is an issue that the town itself can’t do and so political pressure that you’re proposing is the only way to get action,” said Selectman Jim Williams, who joined Chair Mark Paolillo and Selectman Sami Baghdady to sponsor an official resolution backing the measures.

Despite a stall on the House bill and the Senate measure still to be voted on to be included in the Senate’s omnibus energy legislation, Marusiak said communities, citizens, and groups “will just continue to keep on pushing for its passage, now or in the next session.”