Photo: Tom Caputo, chair of the Financial Task Force 2.

With town finances at the precipice of a financial black hole coming this time next year, the Belmont Select Board will ask voters to pass the largest Proposition 2 1/2 override in the town’s history of between $12 to $14 million.

“It’s a big ask,” said Tom Caputo, Select Board member and chair of the Financial Task Force II Committee on Thursday, June 25 as the town faces the duel impacts of the COVID-19 pandemic on state and local revenues while battling a persistent structural deficit that has become the hallmark of Belmont’s fiscal woes.

“It is an incredibly challenging time to contemplate anything of this scale even in a great economy … It is particularly challenging in an environment where we’re looking at an economic recession,” said Caputo.

If the override is successful, the impact the average home assessed at $1.2 million will result in an additional $1,250 to a homeowner’s annual tax bill. If rejected, the town and schools would be required to make crippling levels of cuts in staffing and teachers, limit or cancel programs and cuts in essential services such as police, fire and schools.

“What we hope folks will appreciate is that there is no one silver bullet going to solve this problem,” said Caputo, pointing out that bridging the $12 million deficit with just employee cuts would require a reduction of approximately 120 full time equivalents (FTEs) positions.

“This is not trimming [costs], these are substantial reductions in order to achieve” balanced budgets starting with fiscal year 2022, said Caputo.

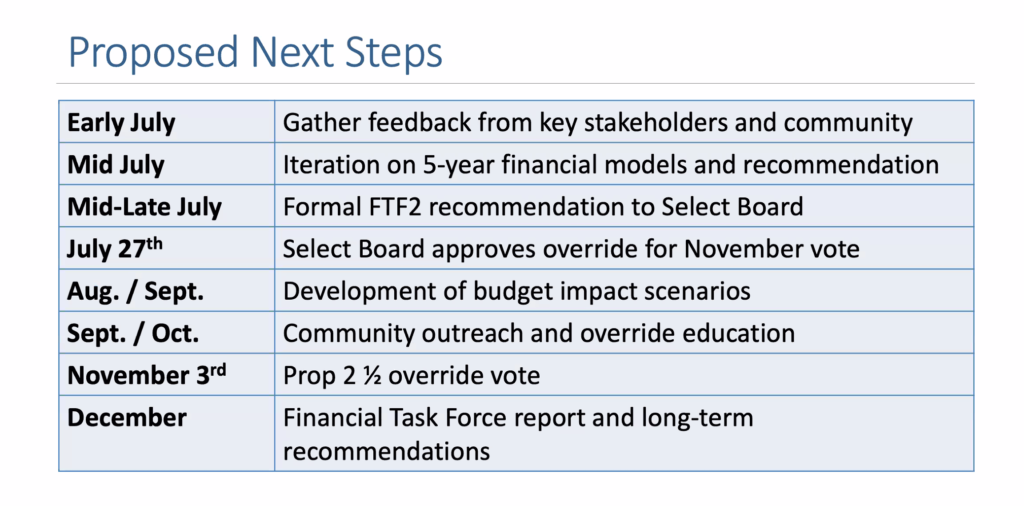

(Image: Town of Belmont)

While the date of the override remains fluid, the task force’s preferences are to link the vote to the Tuesday, Nov. 3 presidential election as the town can anticipate an 80 percent voter turnout – in 2016 82.4 percent of voters cast a ballot – which will provide a “fair and accurate read” of residents sentiment, according to the Select Board’s Adam Dash.

Others believe the November date doesn’t give the town enough time to “educate” voters on the need for a revenue push of such a historic amount.

The reason for the proposed override is the combination of the town’s structural budget deficit which is the result of the town’s nearly exclusive reliance on residential property taxes coupled with a 2 1/2 increase limit on the town’s property tax levy.

While constrained on the revenue side, town expenses related to skyrocketing school enrollment, a steady need for capital improvements and key cost drivers such as health and pension costs, employment expenses and mandated school services continue to rise yearly by 3.5 percent to 4.5 percent. The structural deficit alone would have required an $8 to $9 million override to close in fiscal 2022. Add the continued impact of the COVID-19 on state and town revenue of $3 to $4 million and the override comes in the $12 million range.

The Board and Task Force have expressed some optimism if the override is approved the funds will last several years more than the current projected three years just like the 2015 override.

The most recent Prop 2 1/2 override occurred in April 2015 when voters passed – 55 percent to 45 percent – a $4.5 million increase in property taxes to fund schools, town services, capital projects, road repair and sidewalks. It was the only override to pass in the past 17 years.

Originally meant to last three years, a combination of thoughtful planning, fiscal prudence and a good state economy allowed the town to stretch the funds through the current fiscal year.

The joint committees also agreed that seeking voters’ approval for an override must be conjoined with a concrete five-year budgetary blueprint to mitigate the structural deficit by seeking new sources of revenue and discovering ways to tame costs associated with employee pensions and health insurance.

Despite a great deal of heavy lifting by Belmont officials, residents and town boards and committees to pass the unprecedented override, Dash stated his confidence the measure will pass voters muster.

“I think we have a compelling case,” he said. “[The override] is not due to bad management … it’s due to just some structural issues we’re trying to address in addition to the COVID which is totally unpredictable.”

“If we put the case out there and we show people what they’ll get with it and what they’ll lose without it, they’ll make a fair decision and we’ll move on,” Dash said.