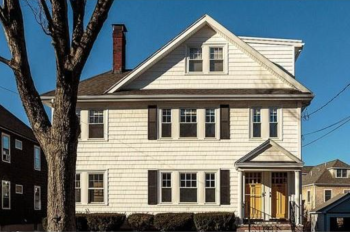

Photo: I paid a million dollars for a house on Trapelo Road and all I got was a stinking common wall!

316 Trapelo Rd., New construction condo townhouse (2015). Sold: $1,040,000.

9 Summit Rd., Condo (2007). Sold: $1,230,000.

A weekly recap of residential properties sold in the past seven-plus days in the “Town of Homes”:

• 316 Trapelo Rd., New construction condo townhouse (2015). Sold: $1,040,000. Listed at $1,100,000. Living area: 2,900 sq.-ft. 9 rooms, 3 bedrooms, 3 full, 2 half baths. On the market: 85 days.

• 9 Summit Rd., Condo (2007). Sold: $1,230,000. Listed at $1,289,000. Living area: 2,715 sq.-ft. 7 rooms, 3 bedrooms, 2.5 baths. On the market: 230 days.

How in demand is Belmont real estate? While not on the level of Boston’s Seaport District or East Cambridge, it’s hot enough to where you can sell a new townhouse condo on Trapelo Road, one of its busiest and bustling streets, for a cool million.

And what do you get for seven figures, besides sharing a common wall – a million dollars can’t get you your own single family house … on Trapelo Road? – with the people who will purchase the adjacent townhouse? You’ll be good friends with the Belmont Fire Department as you’re a stone’s throw from the headquarters and directly across the street from the newest bank branch in town; TD Bank. On your right-hand side is the VFW (for now) and on the left a nice two-family appraised at $565,000. You’ll also be a minute’s walk away from Memorial Chapel and the always open LC Variety, the convenience store favored by people who hold up retail operations. With the traffic, fire engine sirens, traffic going into the bank and other events, hopefully the new owners are an adrenalin junkie.

One advantage will be soon-to-be-renovated tennis courts, and the likelihood PQ Playground (just out of your backyard) will undergo a sprucing up in the next few years. (As someone who lived next to open space – the Chenery playing fields – I can say there is far more upside than down living next to one.)

The original property was a quarter-acre vacant lot which was sold in October 2013 for $545,000 to Oteri Construction Inc. in Watertown, a good all-purpose contractor which will do jobs both big (like the Trapelo site) and small (repair a door lock) which is becoming a rare business in this age of specialisation.

The company then put aside $675,000 to construct a pair of townhouses – they probably couldn’t comfortably squeeze in two singles with setbacks and space between structures – on a good sized lot. Construction began last year this time.

One place Oteri didn’t put much money into was the exterior, a design which is dank and uninspiring (Really? Grey for the shady side facing the street?) But what Oteri is known for is some outstanding interior work like his award-winning kitchen design and construction. The example here is from another project. The kitchen fireplace is a wonderful touch – referring back to the true nature of fireplaces in the history of homes. And what a smart way to incorporate skylights, grouped together in a single room.

(But I have to make down the plan due to the knee-jerk need for granite counters. It screams “Hello, 1982!” There are so many wonderful alternatives to ugly, cold granite; from Soapstone for around the stove top, to composites of stone aggregate and polymers, to my favorite, zinc, which is beautiful as it changes color over time.)

Back to the money: with purchasing the land, the material and construction costs (got to pay these guys with the hammers), think $1.3 million. You’ve just made all but $300,000 back and expect $900,000 for the second townhouse and you’re looking at $600,000 profit. And you get the sirens for free!