Photo: The new Belmont High School auditorium where Town Meeting is expected to take place.

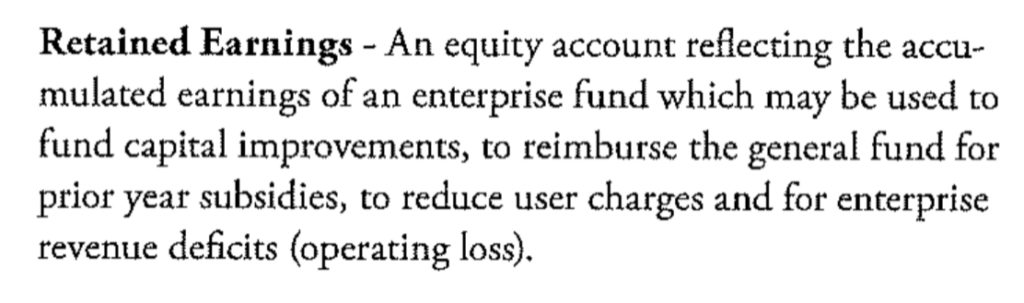

With the budget season underway, the Warrant Committee – the financial watchdog for Town Meeting – has begun creating a series of one-page “explainers” on a variety of topics of interest to Town Meeting members and the public as the town prepares for the annual gathering of the town’s legislative body in June when the budget is taken up.

The first of the one-pagers explores the $7.8 million allocation to Belmont from the $1.9 trillion American Rescue Plan Act (ARPA) to be used over the next two fiscal years. In addition, a further $1 million is heading to the Belmont School District from the Elementary and Secondary School Emergency Relief Fund III.

The ARPA can be viewed here: https://www.belmont-ma.gov/sites/g/files/vyhlif6831/f/uploads/arpa_explainer_-_2_8_22.pdf

While how the ARPA funding is parceled out does not require a vote by Town Meeting, Town Administrator Patrice Garvin will present a draft plan for spending the majority of ARPA funds at a Monday, Feb. 14, 7 p.m. virtual meeting of the Select Board, which has already allocated some ARPA funds to the Board of Health for items such as COVID testing.

Direct all questions to Warrant Committee member Paul Rickter at rickter@gmail.com.