Photo: Just another overflowing receptacle in Belmont

When Mark Paolillo decided not to run for re-election to the then Board of Selectmen in 2019, it was mentioned at the time that board meetings would miss his memorable discharges of distain for people who left garbage, trash and, yes, dog poop on the town’s streets and parks.

“This is outrageous, simply outrageous. This can’t happen,” he cried when viewing the aftermath – beer cans, food containers, plastic bags – of an adult softball game in 2016.

So with Paolillo winning a return to the board earlier this year, it was only a matter of time before the public would hear his clarion call:

”Leonard Street is a mess!” Paolillo said at the Monday, Sept 20 board meeting, barely containing his disgust of anyone knowingly throwing trash in overflowing barrels at parks and in the business centers.

But Paolillo’s anger is not attention seeking but well warranted as anyone who travels through Belmont Center, by eateries around town or in any park or playground can testify, trash is a real problem throughout the Town of Homes. Containers outside the town’s favorite take-out places are overwhelmed while barrels in parks are swamped with all manner of garbage and waste.

“The trash levels that we’re seeing now are pretty substantial,” Jay Marcotte, Department of Public Works director, told the board.

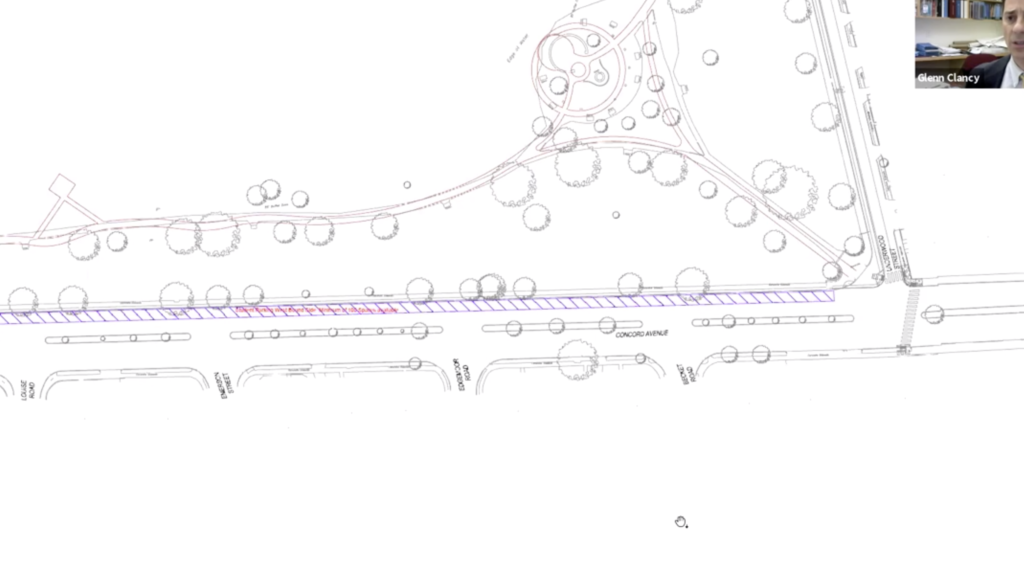

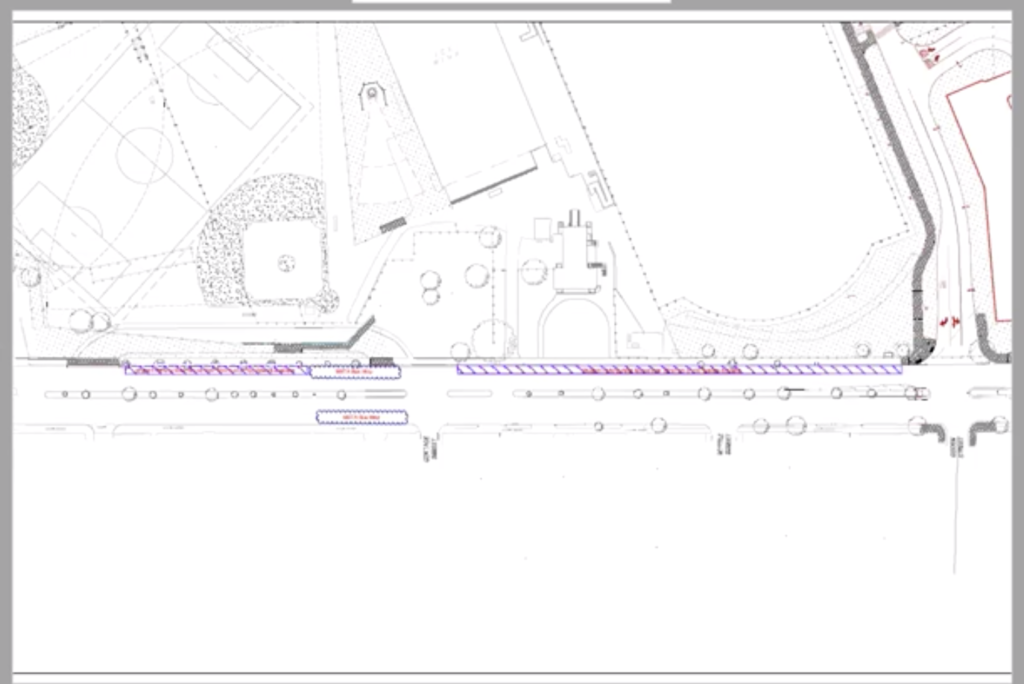

Topped out trash cans and garbage left on the ground is not a new problem. Over the years particular locations such as the aforementioned softball diamond off Concord Avenue, Belmont Center or at Joey’s Park at the Winn Brook School which has become an impromptu site for children’s parties, are in need of collection specifically during the weekend.

The trash cascade begins on Friday evening and continues all day Saturday as residents and visitors come for grab a bite to eat or to attend kids events at parks. And the trash doesn’t stay where its bought or brought. A study from a newly formed local environmental group, Clean Green Belmont, discovered the majority of waste at Clay Pit Pond comes from Belmont Center eateries.

And the jump in trash is more than just a litter or esthetic issue. All that out-in-the-open garbage quickly turns into a public health problem as improperly discarded food contributes to the introduction of rats and other rodents.

So how did the town get in such as predicament? According to Marcotte, much of the increase in waste began in 2019 when the town eliminated overtime for the DPW’s Saturday pickup schedule in a cost savings move. And despite the town’s hauler, Waste Management, emptying town reciprocals three times a week, on Monday, Wednesday and Friday, it does not keep up with the volume for waste produced over the weekend.

Two years ago, the DPW issued a Carry in-Carry out policy that is successful at National Parks but didn’t work in Belmont other than making many residents angry that waste barrels were removed.

In addition, the town had “a very detailed discussion about trash” with Leonard Street businesses when the street became a one way to promote dining and shopping in the Center which led to an agreement that retailers and eateries would install their own trash receptacles which they would have removed.

”I think what we are starting to see is that’s not happening,” said Town Administrator Patrice Garvin.

Vice Chair Roy Epstein said it would be a reasonable takeaway to say that self policing by residents on controlling trash “is not working.”

“This is an example of a public good where the way to make sure it gets done is to have the DPW do it and not rely on somebody’s good intentions,” said Epstein.

Marcotte agreed, saying the return of a DPW weekend collect “is a venture we should look into it and start implementing sooner than later.” Garvin pegged the overtime price tag at $10,000 for two workers from April 1 until the first snow fall in late autumn/early winter.

The board agreed the dollars spent in reinstating the DPW pickup “are insignificant considering the benefit it will have to the community,” said Paolillo.

Garvin will “use her usual resourcefulness” to find the money, said Epstein, either by tapping into town resources or rearranging DPW schedules to allow for personnel to work on Saturday. A plan coming from Garvin will be presented to the board at its next meeting.