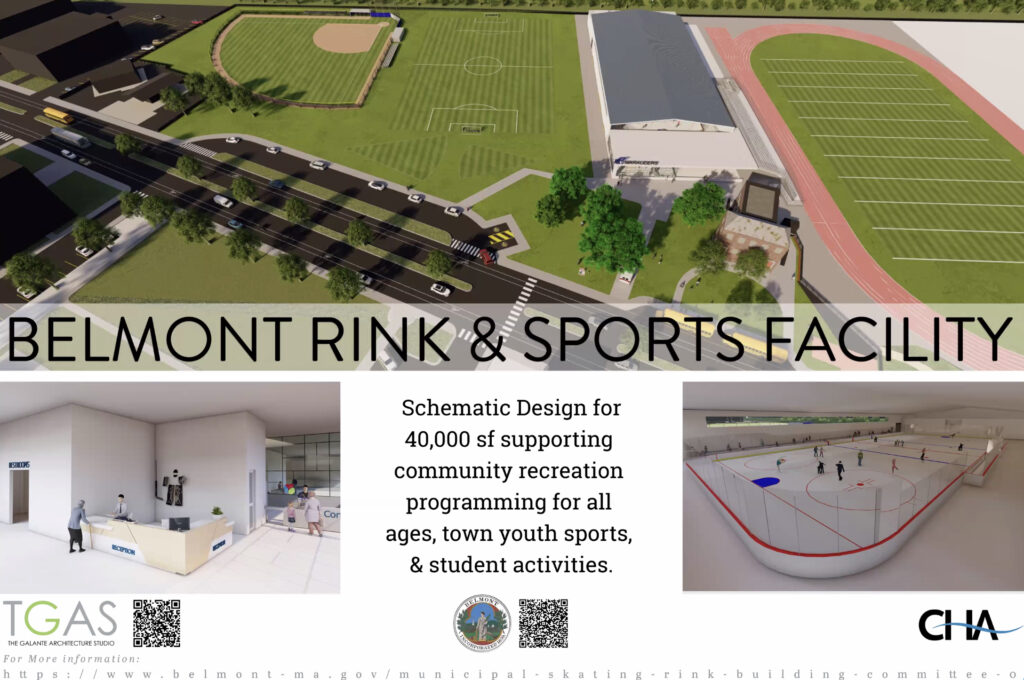

Photo: The first look of the new rink

With less than a month before the vote to determine the future of a new Belmont Rink & Sports Facility, supporters are ramping up events to help convince voters to support a new 40,313 sq-ft skating rink/recreation center at the location of the existing rink.

Public Meeting This Thursday

On Thursday, March 9 from 7 p.m. to 9 p.m., the Municipal Skating Rink Building Committee is hosting a hybrid public forum to update the public on conceptual plans for the new rink/recreation facility to be constructed on the site of the ‘Skip’ adjacent Harris Field.

Discussion will include conceptual design, current costing, energy utilization and year-round facility programming. Speaking will be architect Ted Galante and members of the Building Committee.

The meeting will take place on the third floor, Art Gallery, in the Homer Building in the Town Hall complex or via Zoom to learn more about the project and for an opportunity to provide the public feedback.

Trips of the ‘Skip’

Wondering why people are saying Belmont needs a brand new rink/recreation center? Can’t the existing facility be rehabbed? Put a new coat of paint on it? This weekend is your chance to see “why” a new rink the only solution.

Yes for the Rink, the voluntary campaign spearheading the effort to bring a new rink to Belmont, will be holding tours of the ‘Skip’ – the existing ‘Skip’ Viglirolo Skating Rink – to highlight the dilapidated condition of the half-century old building.

Tours are taking place:

- Saturday, March 11; 10:30 a.m. and 12:30 p.m.

- Sunday, March 12; between 10:30 a.m. and 12:30 p.m.

How Much Will An Average Homeowner Pay For A New Rink

Belmont Town Treasurer Floyd Carman this week has released the calculations on the cost to the “average” homeowner if voters approve the debt exclusion for a new rink at the April 4 Town Election. With a current net price-tag of $28.6 million – the $29.9 million construction cost minus $1.3 million in fundraising money – the owner of an average single family house, currently valued at $1.4 million – would see their residential tax increase $248 per year over the 30 years of the debt exclusion.