Photo: Belmont has not sought to bring back a mask mandate with the latest spike in Covid-19.

With the new year of 2023 bringing a jump in Covid-19 related hospitalizations and in overall cases in Middlesex county, the town of Belmont and the school district are taking a deliberate approach in its answer to the surge.

“At the moment, we are cautiously optimistic because we are not seeing a post-holiday spike in COVID-19 related absences in the schools like we had in recent years,” Wesley Chin, director of the Belmont Health Department, told the Belmontonian on Monday.

The Massachusetts reported on Jan. 5 that Middlesex County had reached a ‘High’ community level which is a combination of reported Covid cases and hospitalization due to the coronavirus. The recent spike in cases and those in the hospital was not unexpected as people are spending more time indoors where viruses can easily spread. Nationwide, nearly 20 percent of US counties are at the high level of Covid risk.

When areas reach the high level, the US CDC recommends citizens return to wearing a high-quality mask – N95, KF94 and KN95 – when indoors in public. The CDC also recommends those at high risk of getting very sick – the elderly and those with compromised immunity – to consider avoiding non-essential indoor activities in public where you could be exposed.

“If you have household or social contact with someone at high risk for getting very sick, consider testing before contact and wearing a high-quality mask when indoors with them,” advised the CDC in a press release.

So far, the Health Department is taking a watch and advise approach to the recent surge.

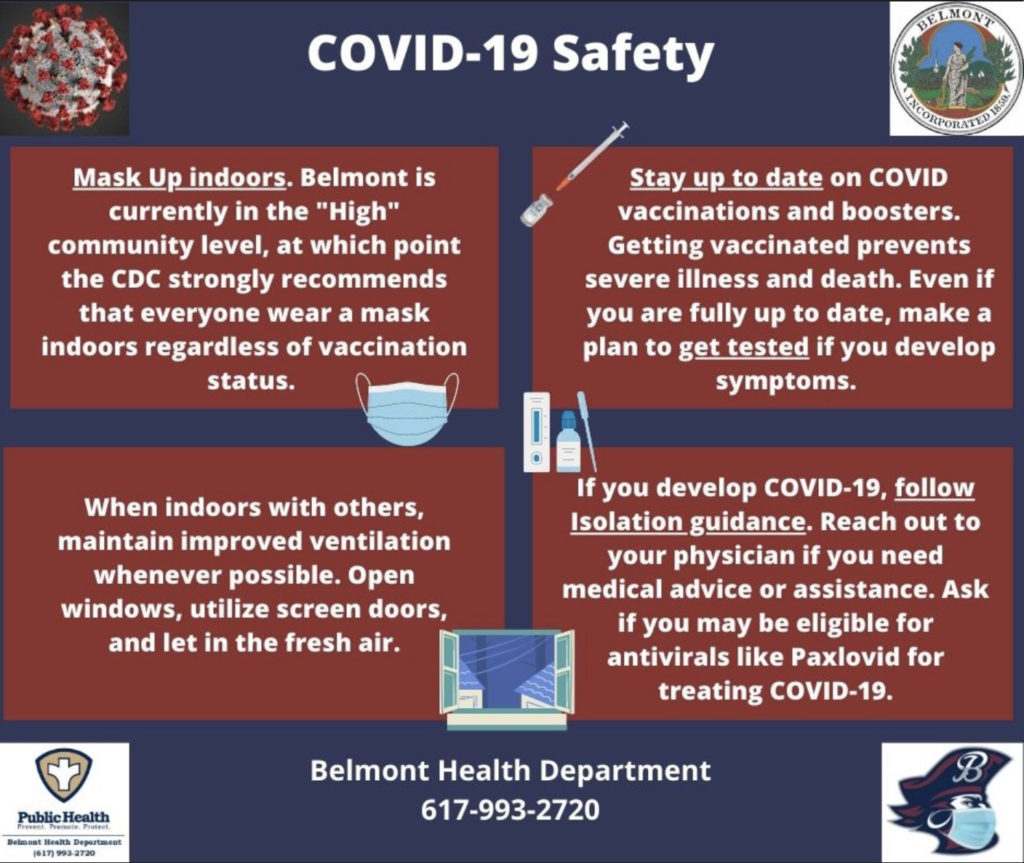

On the day the high level was reported, the town’s Health Department shared a shared a ‘COVID-19 Safety’ infographic with the community to remind residents about the readily accessible tools at hand that can help protect individuals from severe infections from COVID-19. (See the Infograph at the bottom of the page)

“The Health Department continues to monitor local and regional COVID-19 metrics. We are also in regular contact with the Head of Nursing and Superintendent for the Belmont Public Schools to monitor student and staff attendance throughout the district,” said Chin.

Initial data has been promising, said Chin.

“At the moment, we are cautiously optimistic because we are not seeing a post-holiday spike in COVID-19 related absences in the schools like we had in recent years. Additionally, COVID-19 waste water data provided by MWRA suggests that current COVID-19 infections may be on the decline in the north region,” said Chin.

While the town has not reinstated an indoor mask mandate for public and private locations with common spaces, “Belmont will always be a mask friendly community,” said Chin. “But, the best way to prevent adverse outcomes is to continue to stay up to date with bivalent booster shots,” he said. Belmont ended its indoor mask mandate in March 2022, approximately two years after it was declared.

In that regard, Belmont is ahead of the game with a high rate of vaccination among residents, with most age groups having reached a 95 percent-plus fully vaccinated rate.

While vaccinations do not prevent contracting the virus, it does lessen the severity of the illness and in nearly all cases of those fully vaccinated will prevent an hospital stay.

“We believe the high rate of vaccination in Belmont is likely playing a protective role in allowing us to weather the current surge of cases in the Northeast with less disruption to everyday life this year,” said Chin.