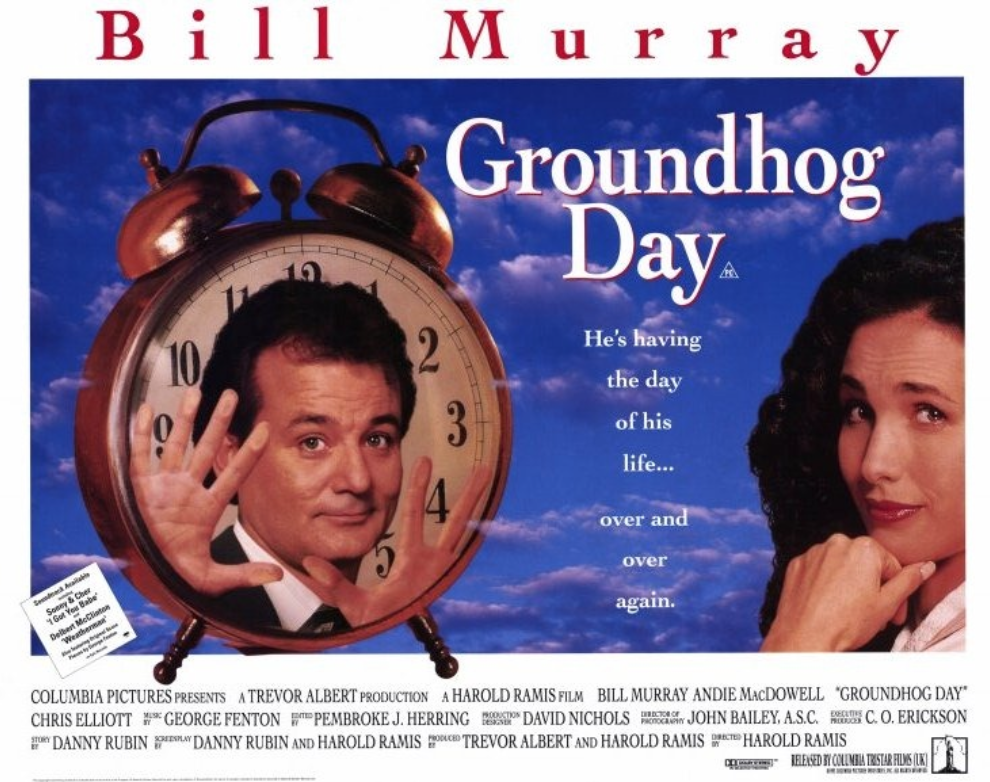

Photo: Groundhog Day, the movie.

Some may find it ironic that the developer of Cushing Village, the troubled retail/residential/parking project at the corner of Common Street and Trapelo Road, will be before the Planning Board on Groundhog Day, Tuesday, Feb. 2.

Wry laughter reverberated through the Board of Selectmen’s room when the Planning Board’s Karl Haglund mentioned the confluence at the board’s Tuesday, Jan. 19 meeting. It was not lost on most people the long-stalled development reminds many of the classic 1993 film of the same name in which Bill Murray finds himself repeating the same day (Groundhog Day) over and over again.

Only here, it is the board and residents who had been reliving the same issues and promises from Cushing Village’s developer, Chris Starr of Smith Legacy Partner Series, since July 2013 when the Planning Board approved a special permit and design and site plan review to allow construction to start on the 164,000 sq.-ft., three building project.

All that is missing is hearing Sonny and Cher sing, “I’ve Got You, Babe” that starts each new/same day in the film.

Cushing Village and its future were part of the Planning Board’s agenda this week as the body received a written update from Starr’s development team, a board request made earlier in the month after Smith Legacy failed to meet a series of “hard” deadlines it had committed to meet in December.

This second update, dated Jan. 19, was revealing for its lack of specifics and the acknowledgment that Starr is using the two abandoned buildings on the site as his main collateral to secure construction financing. It also avoided mentioning Starr purchasing the municipal parking lot adjacent to Trapelo Road, which is a key to moving the project forward.

“I’m surprised that we still haven’t heard the target date about the closing (on the parking lot) given that we heard many times that the date was close, and all but one document was needed the last time they were here in December,” said Planning Board member Barbara Fiacco.

“I was expecting this update to address the closing date issue,” said Fiacco.

Even the supposed good news of finding potential tenants for the troubled project, there is a concern the news is not as bright as it appears.

For the second time in as many weeks, Starr said his search for a “small-format food store anchor tenant” is “progressing” yet could not confirm that a lease was close to being signed.

“We are in discussions with a financially strong, experienced, market[-]leader that prides itself on providing fresh, high-quality prepared food and other necessities in a small format store,” wrote Starr, saying the store will take up 15,000 sq.-ft.

While announcing the signing of two leases – a store and a restaurant – to fill the 38,000 sq.-ft. retail space, Starr refused to detail the who, what, and how long of the potential occupants.

The restaurant, dubbed “Arigna”, is only described as taking 5,000 sq.-ft. Starr does not name the owner or the type of establishment, although there is some indication that it would be in the Irish pub category as Arigna is the name of a small coal mining town in Ireland. The only other establishment with that name is in Pawtucket, RI.

And while heralding the signing of a “major national tenant,” Starr claims “confidentiality.” While noting the national brand coming to the site, it will likely be a small outlet. Saying the three retail operators will take up 22,400 sq.-ft. and the restaurant and market using 20,000 sq.-ft., the national tenant would be in the 2,400 sq.-ft. range. Some popular commercial uses for that space requirement includes reduced-sized bank branches or a 7-11 convenience store.

Even if Starr can close on three leases, the retail component will only be 60 percent of capacity, with 15,000 sq.-ft. remaining “vacant.” In comparison, two under-construction commercial buildings in nearby Watertown have sold out their retail space which is in the 25,000 sq.-ft. range. Starr has stated that “construction financing has hinged in the past on our retail pre-leading activity.”

But it was Starr’s explanation why demolition has not yet begun that raised the eyebrows of some board members and those in the audience. He revealed the two abandoned and dilapidated buildings on the site, the former S.S. Pierce & Co. and the First National/CVS, is the development company’s “current bank collateral for our mortgage.”

“While our current bank [Wells Fargo] bank might allow us to perform selective small-scale demolition, we don’t think doing a portion of he demolition destruction will help move [along] the project,” said Starr.

“I was surprised that they are only revealing now that the existing, mostly vacant buildings are the collateral for their existing mortgage because part of the agreement they made was to do the demolition on an early timetable,” said Haglund. “Maybe he was optimistic moving on to the closing.”

Starr said he expects to close on the parking lot on or before Feb. 2.

Leave a Review or Comment