Photo: Belmont Savings Bank.

Belmont Savings Bank, the town’s largest business, delivered another record financial quarter, driven by increased deposits and earnings tied to loans.

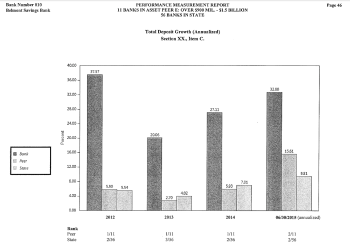

In both deposit and asset growth, Belmont Savings is among the fastest growing banks in the state and among its peers.

As of Sept. 30, total assets at Belmont Savings reached $1.7 billion, an increase of $267 million or 19 percent from the $1.4 billion in assets at the beginning of the calendar year.

The asset growth was primarily funded by growth in deposits. On Sept. 30, deposits totaled $1.2 billion, an increase of $224 million or 23 percent from $985 million nine months earlier on Dec 31, 2014.

According to the Depositors Insurance Fund, through the first half of 2015, total deposit growth (annualized) at Belmont Savings was more than double – 33 percent to 16 percent – its peer group (10 banks between $900 million and $1.5 billion in assets) and well head of all banks in the state.

“[The third quarter] was another quarter of steady deposit growth. We are pleased with the ongoing success of our municipal and business banking strategies which were the primary drivers of this growth,” said Hal Tovin, executive vice president and Chief Operating Officer.

The bank reported net income increase 55 percent in the third quarter to $1.9 million, compared to $1.2 million, for the same three month period ended Sept. 30, 2014, or an increase of 55 percent.

This marks the ninth consecutive quarter of earnings growth.

The company experienced net loan growth of $248 million, or 21 percent from Dec. 31, 2014.

There were significant increases in each individual loan catagory:

- Residential 1-4 family real estate loans: $185 million

- construction loans: $33 million

- commercial real estate loans: $30 million

- home equity lines of credit: $20 million.

“Through strong organic growth and expense control, we continue to improve our profitability. Importantly, credit quality remains sound,” said Robert Mahoney, president and Chief Executive Officer, in a press release distributed on Oct. 21.

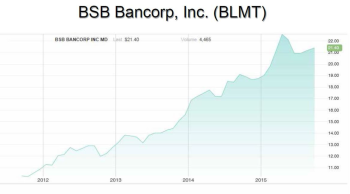

Since taking the bank public on the NASDAX, the stock price has more than doubled.

Leave a Review or Comment