Photo: The town has created a calculator to determine your taxes with a successful override. (Credit: Wikipedia)

One of the burning questions that many homeowners have with the proposed $6.4 million Proposition 2 1/2 override is “how much will it cost me?” The first estimate from town officials gave a general idea of the price tag: about an extra $900 per year on the “average” property valued at $1,125,000.

But that round figure was not cutting it for many owners who asked the town in previous public meetings to come up with someway make the cost a bit more specific.

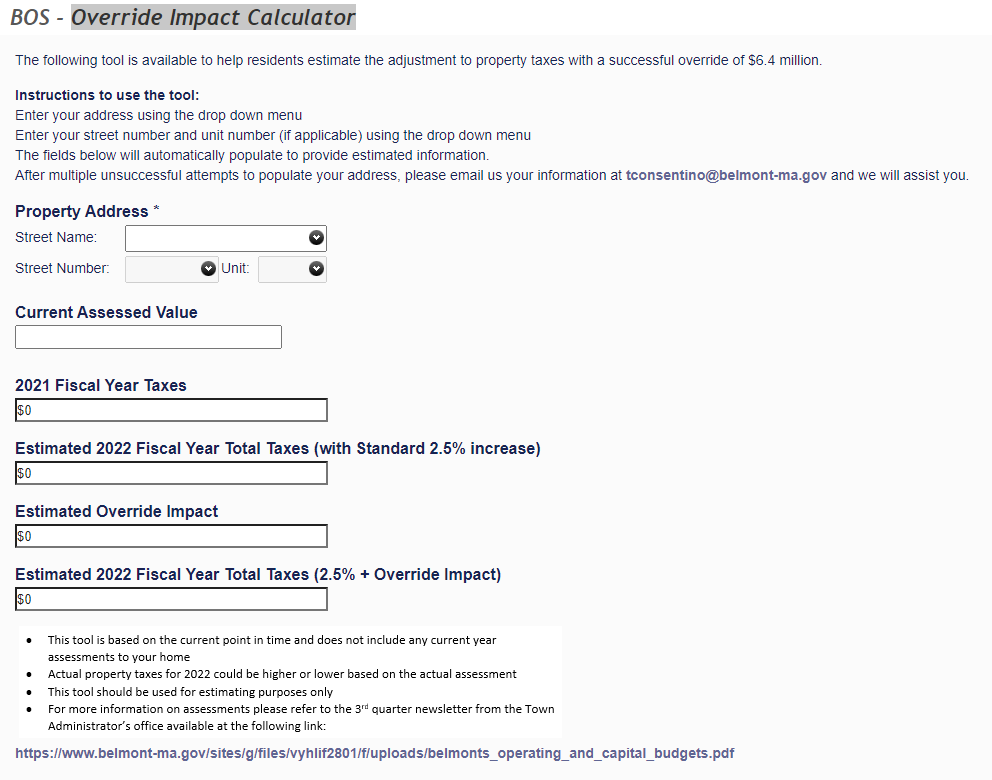

They asked, and the town now has the answer. The town has created the Override Impact Calculator, a simple application in which all a person needs to do is input their address and the calculator will take the latest assessed value and calculate both the override amount and the annual 2 1/2 percent tax increase.

“This came out of [Financial] Task Force meetings with the hope to get more information to the residents,” said Town Administrator Patrice Garvin who helped introduce the override calculator at the Select Board meeting on Monday, Feb. 1.

“This is an opportunity for us to get beyond just the averages and talk about specifically how individual homeowners and taxpayers are impact so I think it’s great,” said Board member Tom Caputo, who is also the chair of the task force.

Belmont is forcing the elderly to pay too big of a price. It is time to for the town to show it is not just for the high income residents. People who have lived their entire life in Belmont should not be pushed out.

Tax override is not sustainable

my property tax increased 20% in the past two years. That is way too much for us to handle.

You can use tax override to fix a structural deficit. The town has to bite the bullet and spend according to how much the town can afford.

So, from FY 2019 to FY 202002, a span of 3 years, my real estate tax has increased by $3100, averaging over $1000 a year., for a small 6 room house, due to an override and a debt exclusion. The impact on the budget of a senior on a small pension is devastating. .