Photo:

With the reality of a large override hanging over the town’s head for next year, a looming gap facing the schools in the coming fiscal year, and a national economy impacted by stubbornly high interest rates, it’s almost a comfort knowing the current fiscal year 2023 Belmont budget has reached its midpoint with little drama.

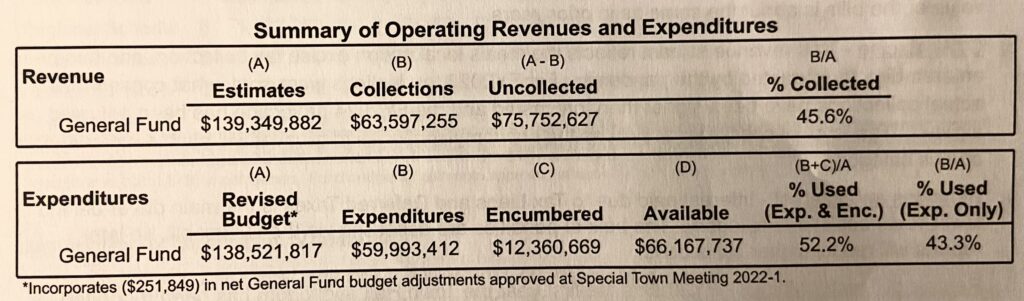

In a report on the end of second quarter figures compiled by the town’s financial Triumvirate – Town Administrator Patrice Garvin, Financial Director Jennifer Hewitt, and Budget Analyst Matt Haskell – “that both expenditures and revenues are in line with management’s expectation” as the fiscal year reached its midpoint.

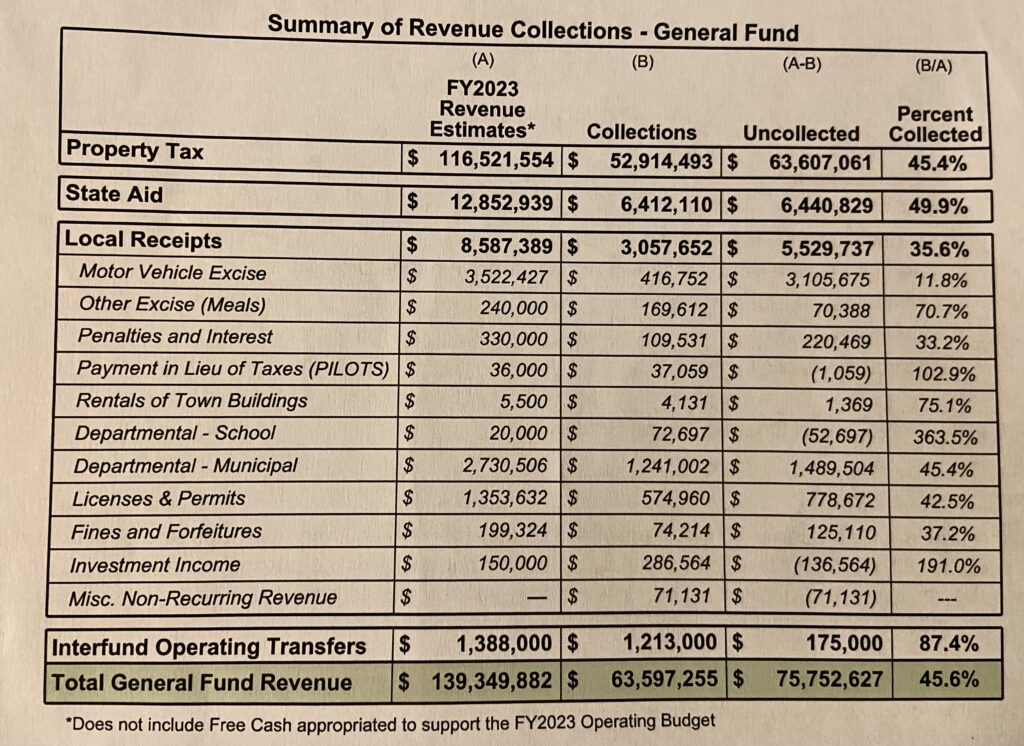

With the assumption that collected revenues and department expenditures would be around 50 percent, revenues came in at 46 percent ($63.6 million) of the estimated annual predicted amount of $139.3 million with 83.6 percent coming from property taxes. One highlighted line item was the meals tax, which brought in $169,612 through the first two quarters, 70 percent of what it expected to bring in.

“The level of consumer activity as the economy continues to recover will have a direct impact on this category,” said the report.

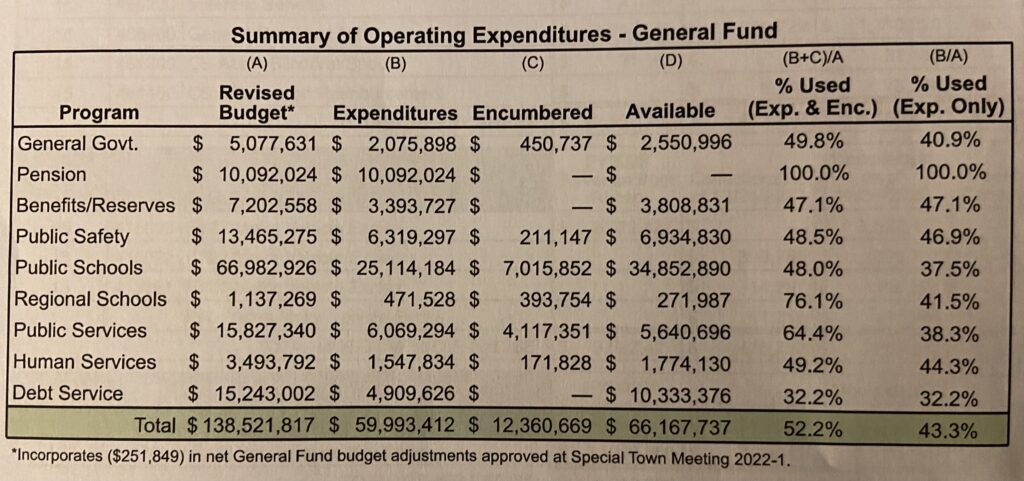

Expenditures and encumbered items were running at 52.2 percent, with $66.2 million still available. The report noted that the public safety category is running just below 50 percent of expenditures and encumbrances; it does not include retroactive payments that the salary reserve will cover.

“Once those contracts are implemented, staff will be better equipped to forecast the end of the fiscal year,” expressed the report.

And the dry and warm winter with only a smitten of snow – not near the average 50 inches Belmont expects – resulted in the Department of Public Works not having to dip into its snow and ice budget, “contributing to the low spending percentage.”