Photo: An override will be on the April 6 town election ballot.

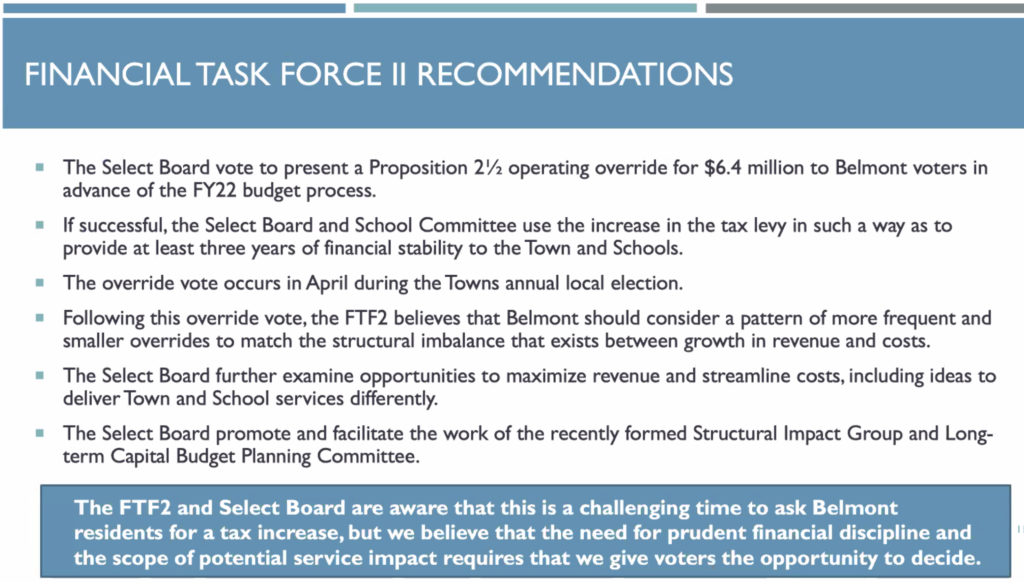

The Belmont Select Board unanimously accepted the Financial Task Force’s recommendation to place a $6.4 million Proposition 2 1/2 override on the April 6, 2021, town election ballot.

While the vote comes in the midst of a year long pandemic which has wounded the local and national economy, there is few alternatives other than huge cuts in town services – with massive layoffs – and a retreat on nearly a decade of investments in teaching and student growth.

“It’s never the right time or a good year to ask for this … but the situation has put us in a point where we have no choice,” said the Select Board’s Adam Dash.

Select Board’s Tom Caputo, who also chaired the Task Force, said working for the past two years using a multi-year financial forecasting modeling tool from the Collins Center at UMass/Boston to help make more precise results from projections and data allowed him to “appreciate the financial challenges ahead of us and the importance of an override to maintain fiscal stability for the town.”

I am very comfortable with the recommendation that we brought to the town,” he said.

If approved by voters, homeowners would see a $900 pop in property taxes on the “average” valued house pegged at $1.25 million.

The override amount is approximately half the $12.5 million the Select Board approved back in July.

“I think that’s progress,” said Roy Epstein, chair of the Select Board.

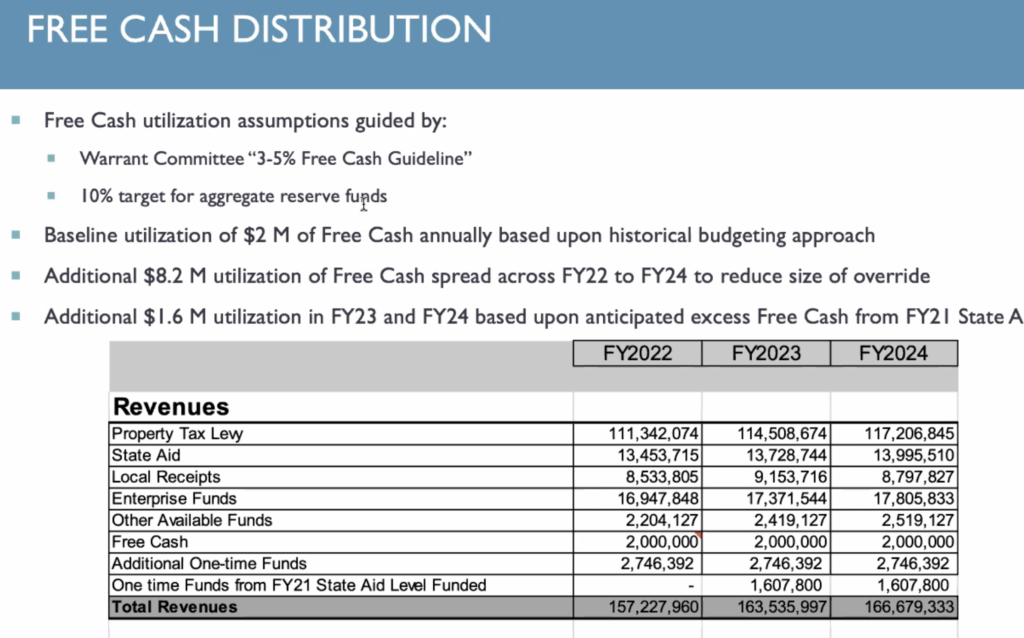

Flush with nearly $11.2 million in free cash certified by the state – an amount historically higher than most years through minimizing expenditures during last year’s COVID crisis – and the recent forecast of state and local revenues will be higher than pervious years, town will leverage the onetime windfall to help moderate the override’s size, said Caputo.

After setting aside portions of free cash according to decade long town guidelines, the town will take $8.2 million in free cash and spread it over three years from ’22 to ’24. Include $3.2 million in additional state aid in fiscal ’22 split between fiscal years ’23 and ’24.

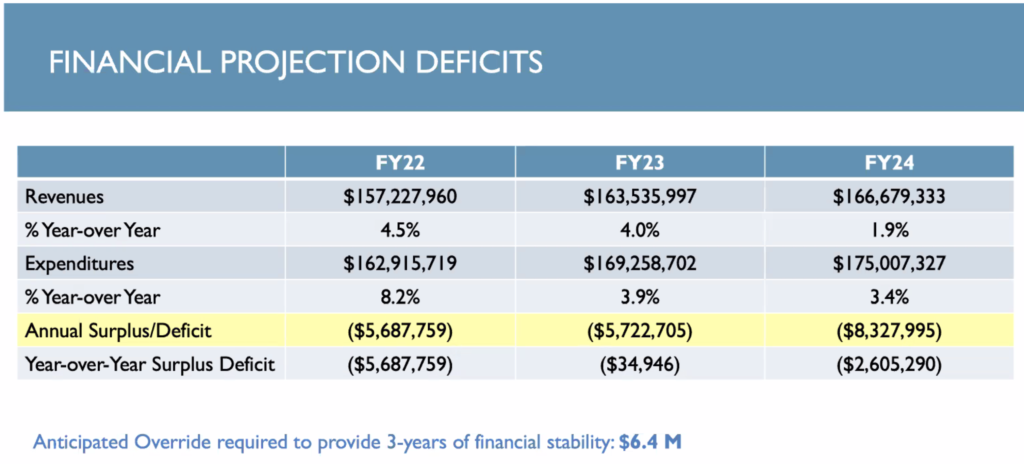

The task force forecasts that Belmont would be facing a debt of $8.3 million by fiscal ’24 on an annual budget of $166.7 million.

The override would allow the town to support a “minimal level service budget” as it will maintain town services with “very very small additional positions” such as a social worker at the Senior Center, said Dash.

But for several residents who commented during the public comment portion of the meeting, just the tiniest jump in taxes would be devastating to many.

“Any dollar increase for us right now is too much considering the thousands of dollars in revenue that we’ve all lost and the percentage of business down,” said Deran Muckjian, a lifelong resident and owner of The Toy Shop of Belmont on Leonard Street.

Dawn McCarren said a lot of good ideas have come from the task force “but the town will survive without an override.”

“I realize that there will be cuts but families are at stake and this is extremely difficult pill to swallow, forcing some to sell homes where residents lived for multigenerationd,” she said.

No short-term solution

But the Board contend the town has not other short-term option but to back placing the override on the ballot.

“I recognize that we have a lot of folks in the community that are in economically challenging times as a result of COVID, that are on fixed incomes for which this tax is an incredible burden and it’s hard for us to solve,” said Caputo.

“At the end of the day, this override is indicated by the facts and the realities and as such it needs to be put on the ballot,” Caputo said.

A delay, said Epstein, would made a bad situation even worse, as cuts would be made to services, nearly the entire free cash account would be used in one year which would imperil the town’s “gold standard” AAA bond rating and ultimately require a much more robust override amount in 2023.

Epstein also wanted to dampen down any suggestions that, as one resident said in an email, voters suspect the funds raised through the override would be spent on “grandiose capital projects.” The reality, he said, was the additional funds will be directed to operating expenses such as paying for teacher salaries while continue vital infrastructure projects.

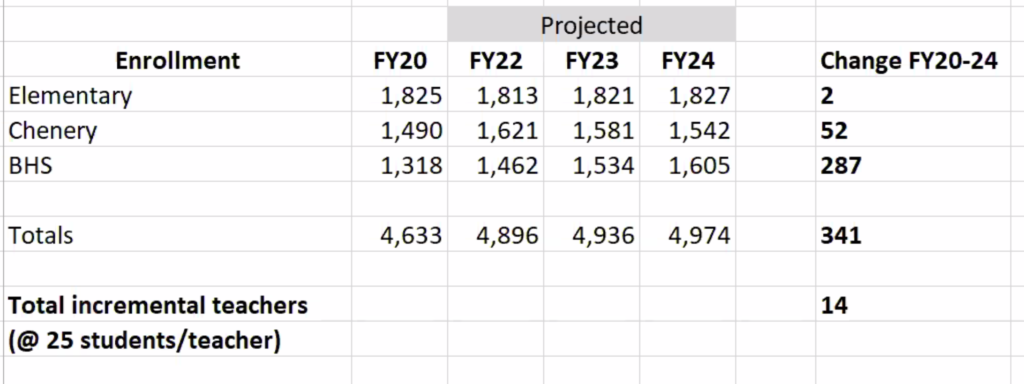

Epstein did acknowledge the fiscal ’22 education expenses accedes what he believes is a minimal level but that is due to the district introducing a new school – the Chenery Middle School at the high school location – in the next two years and to maintain “considerable progress” its has invested in over the past five years.

School costs will continue to lead the way adding more than 32 FTE (Full-time equivalent) positions in the next three years “to address increase in enrollment, grade configuration and what the school committee’s vision for the future,” said Patrice Garvin, town administrator, at last week’s meeting of the Select Board.

Yet also noting that an override will have little impact on the town’s structural deficit in which revenues are unable to match expenses due to annual limits on property tax increases while education costs due to students entering the district – a 1,000 new pupils in just the past few years – has far outpaced revenues.

Dash said the town has created two new committee, the Structural Budget Impact Group and Long-term Capital Budget Planning Committee, which will look for opportunities to increase revenues and decrease expenses. Around March, the town will open a portal on the town’s web site where people will be able to put in any structural change suggestions for the boards to review.

“There are no stupid ideas, every idea will be looked at and vetted, put into a matrix and analyzed,” said Dash.

Looking into the horizon, Epstein believes Belmont may finally see by 2026 some stability or even slight decrease in the decade of sky rocking enrollment – greater than 10 percent over the past 10 years – in town schools which will in turn decrease the need to hire teachers, staff and other expenses.

“As soon as there’s stability in the number of schoolchildren instead of this continuous very rapid growth that will give us a lot more flexibility in managing the budget,” he said.

Greater detail on the budget planning for the next three fiscal years can be found in the documents at the Town of Belmont website.

In addition, Belmont Media Center has recorded Financial Task Force meetings.