Photo: One of Belmont Savings’ supermarket bank branches.

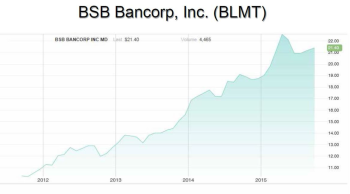

BSB Bancorp, the holding company for state-chartered Belmont Savings Bank reported Thursday net income for the year ending Dec. 31, 2015 rose to $6.9 million, compared to 2014’s $4.3 million, an increase of 61 percent.

“Through strong organic growth and expense control, we have achieved 10 consecutive quarters of earnings improvement. Credit quality remains good,” said Robert Mahoney, president and chief executive officer.

On the last day of 2015, BSB’s total assets reached $1.81 billion, an increase of $387 million or 27 percent from $1.43 billion on Dec. 31, 2014.

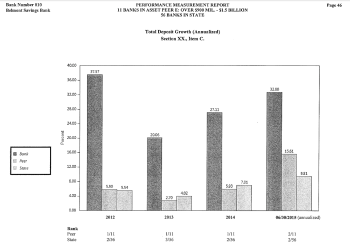

On Dec. 31, 2015, bank deposits totaled $1.27 billion, an increase of $285 million or 29 percent compared to $985 million reached the last day of ’14.

“Our deposit growth throughout 2015 was an important, cost-effective funding source for loans our strong asset growth,” said Hal Tovin, executive vice president and chief operating officer.

“We were very pleased with the fact that it came from building customer relationships in many business segments – most notably business banking, municipal banking and commercial real estate,” said Tovin.

The bank experienced net loan growth of $356 million, or 30 percent, from Dec. 31, 2014, with increases across the board:

- Residential 1-4 family real estate loans: $259 million.

- commercial real estate loans: $54.2 million

- construction loans: $29.3 million

- home equity lines of credit $28.4 million.

- commercial loans: $14 million.

Total stockholders’ equity increased by $9.2 million from $137 million as of Dec. 31, 2014 to $146.20 million as of Dec. 30, 2015. This increase is primarily the result of earnings of $6.9 million and a $2.2 million increase in additional paid-in capital related to stock-based compensation.